Asset Allocation Foundations, our asset allocation strategies, covering both listed and private assets, focus on these principles:

Asset Diversification

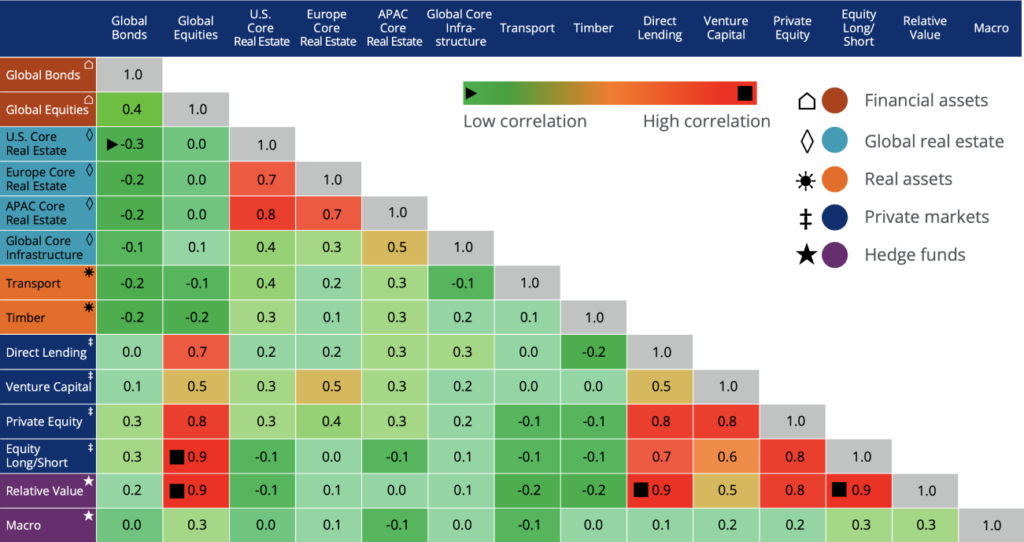

Investing in non-correlated assets spreads risk across different asset classes.

Public and private market correlations, quarterly returns (Q2 2008–Q1 2024), %

Sources: J.P. Morgan Asset Management, Bloomberg Finance L.P., Burgiss, Cliffwater, FTSE, HFRI, MSCI, NCREIF. Note: Green = low correlation.

Volatility Reduction

Non-correlated assets can reduce overall portfolio volatility by offsetting losses in some areas with gains in others.

Systematic Risk Mitigation

Diversification reduces exposure to macroeconomic factors impacting the entire market.

Risk-Return Optimization

Incorporating non-correlated assets enhances the portfolio’s risk-return ratio, potentially increasing returns for a given level of risk.

Economic Cycle Protection

Non-correlated assets protect portfolios from economic downturns by mitigating the underperformance of specific asset classes.

Negotiating Service Cost

Price disparities among service providers can significantly impact client performance. We continuously negotiate on behalf of our clients to ensure they receive services at fair and optimal prices.